Understanding Comprehensive vs. Collision Coverage in Utah

Confused about comprehensive vs. collision coverage in Utah? Learn the key differences, when you need both, and how they fit into full coverage auto insurance.

When it comes to protecting your vehicle in Utah, youve likely come across two major types of optional coveragecomprehensive and collision. While both provide valuable financial protection, they cover very different situations. Many drivers are unsure whether they need one, both, or neither, especially if they already meet Utahs minimum liability requirements.

Lets break down what these coverages mean and how they fit into a smart auto insurance strategy.

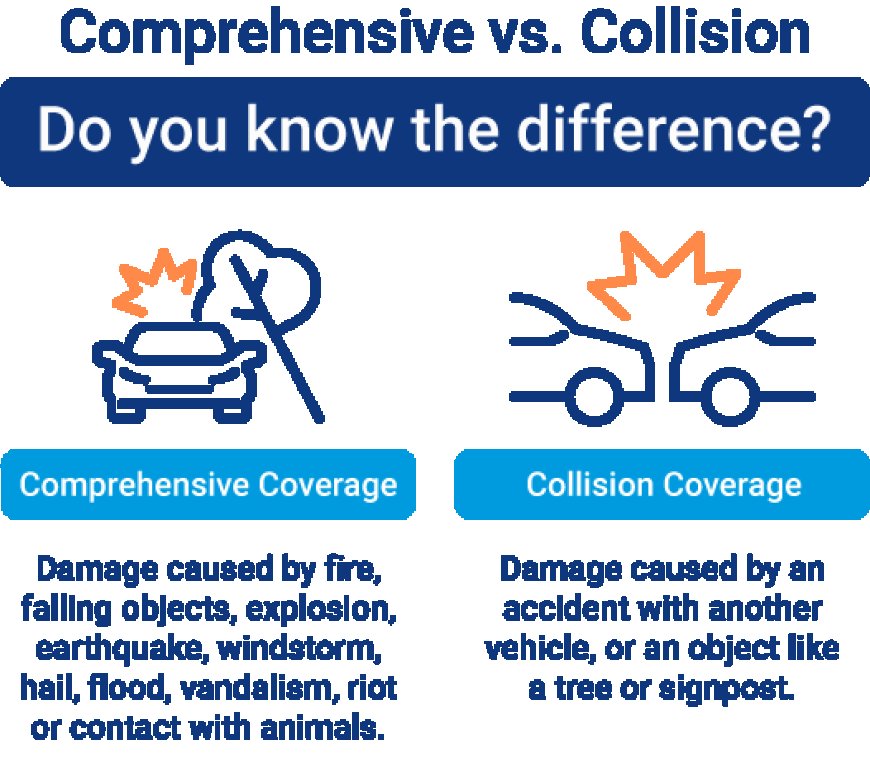

What Is Collision Coverage in Utah?

Collision coverage pays for damage to your car after an accident, regardless of who is at fault. This includes:

-

Accidents involving another vehicle

-

Hitting a stationary object, like a tree, pole, or guardrail

-

Single-car rollover accidents

For example, if you slide on icy roads in Salt Lake City and hit a guardrail, collision coverage would help pay for the repairs to your vehicle.

Drivers with newer or higher-value cars often keep this coverage because repair costs can be significant.

What Is Comprehensive Coverage in Utah?

Comprehensive coverage, on the other hand, protects against non-collision-related damage, such as:

-

Vehicle theft or vandalism

-

Weather damage from hail, flooding, or falling branches

-

Damage caused by animals, like deer strikes

-

Fire or explosions

This coverage is especially important in Utah, where unpredictable weather events and wildlife-related accidents are relatively common.

Do You Need Both Coverages?

Whether you need comprehensive AND collision depends on your vehicles value, your budget, and your personal risk tolerance.

-

If your car is financed or leased: Most lenders require both types of coverage until the loan is paid off.

-

If your car is older: You might skip one or both coverages if the vehicles value is low compared to the cost of premiums.

-

If you want full protection: Combining both gives you whats commonly referred to as full coverage auto insurance Utah drivers often rely on for peace of mind.

Full coverage isnt a specific policy but rather a mix of liability, collision, and comprehensive, offering broader financial protection.

When Does It Make Sense to Drop Coverage?

If your cars actual cash value is less than the annual premium for collision and comprehensive combined, it might not be worth keeping them. For example, if you own a 15-year-old car worth $2,000 but youre paying $800 a year for these coverages, dropping them could make financial sense.

However, always consider your ability to pay for repairs or replacement out-of-pocket before making the decision.

Balancing Cost and Protection

Comprehensive and collision coverages both add to your premium, but they can save you thousands in the right situation. To lower costs while staying protected:

-

Increase your deductible to reduce premiums.

-

Install anti-theft devices for potential discounts.

-

Shop around for insurers that reward safe driving or bundle discounts.

Final Thoughts

Comprehensive and collision coverage serve distinct but complementary roles. If your car is newer or youre risk-averse, keeping both ensures youre covered for nearly any situation. If your vehicle is older and you can afford potential repairs, you might only need liability coverage.

Review your policy annually to make sure your coverage aligns with your vehicles current value and your financial comfort level.